Joe Zidle: A More Familiar World in 2021

We remain optimistic on the outlook for next year. The daily headlines can be discouraging, to say the least; COVID cases are resurgent as colder weather forces people indoors, schools are going virtual, and many of the jobs recovered after the first wave are at risk again. No doubt, the months ahead will be challenging. However, let’s not forget the remarkable progress made recently. We have more certainty on the US election outcome, better therapeutic treatments, more readily available testing and, the best news of all, multiple efficacious vaccines appear to be on the way.

All this gives us reason for great hope that we can return to a more normal, familiar world sooner than was thought possible just a few months ago. In our view, normal means the resumption of the routine social activities we once took for granted, without substantial fear of contracting the virus; kids in classrooms, travelers on airplanes, and workers in offices. And when that happens, we expect the economy will experience a temporary boom in growth rates as pent-up demand from lockdown fatigue is released.

Potential Timing for a Return to Normal

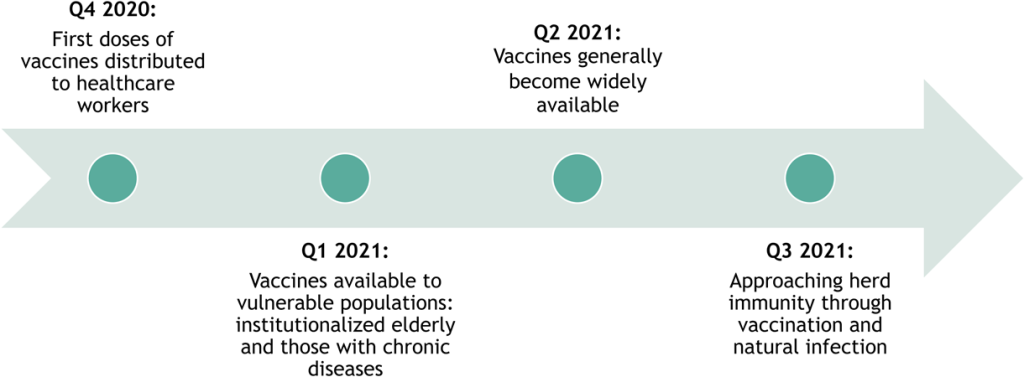

Recently my team and I, in conjunction with Blackstone’s Real Estate Asset Management team, spent time with a health and security services firm to discuss when we might expect a return to normalcy. Figure 1 shows a potential base case scenario for the US.

Figure 1: Illustrative Base Case US Vaccine Timeline

Under this base case, by the end of Q1 2021, the number of new cases stabilizes and therapeutic treatments generally lessen the severity of illness. Effective antigen testing further reduces new cases. Hospitalizations decline due to better treatments, including monoclonal antibodies, outpatient antivirals, and improved home care. Steroids, anti-coagulants, and better respiratory management, already proven effective, continue to lead to improved outcomes.

By Q2, the Pfizer and Moderna vaccines, and potentially others, enter the mainstream. While vaccines alone cannot achieve herd immunity, a 90% effective vaccine taken by half the population can get us close. COVID’s reproduction number (R0)—the number of people one person with the disease is likely to spread it to, on average—is estimated to be 2.5. At this rate, 60% of the population needs to be resistant to achieve herd immunity.1

By Q3, low-cost tests that provide rapid results should be available for use at home. One type of test that seems likely to be available is a lateral flow test, which functions similarly to home pregnancy tests. If tests like this are widely available, low-cost ($1–$2 each) and rapid, it will be much easier for people who are asymptomatic, but potentially contagious, to get a test. Another example is the recently approved, although still limited use, low-cost rapid Abbott BinaxNOW test, which comes with a companion smartphone app. We can imagine an environment where businesses create COVID-negative bubbles by asking patrons to either take a rapid test or show recent test results via a smartphone app.

Admittedly, these are the lights at the end of the tunnel, and predictions for these developments are beyond anyone’s ability to model with any real precision. Additional considerations include the willingness of people to take the vaccine and various black swan events should any safety issues crop up. We also do not want to minimize the suffering that people will endure as COVID resurges. Major economies around the world are back in full lockdown, and Europe is likely to fall back into negative growth this quarter. Vaccination programs in emerging markets will be hampered by the cold storage supply chains required to safely transport approved drugs. The US will likely avoid a widespread lockdown this time, but even targeted, local shutdowns will cause broader pain in the economy and labor markets.

Post-Election Macroeconomic Outlook

Long-term unemployment a growing problem The economy has the potential to run hot next year. Growth rates could be significantly above average, at least on a temporary basis, as liquidity and savings meet increased mobility. Even so, the foundation is being laid for a long economic cycle. The question right now, looming increasingly large for the recovery, is whether the federal government will extend enhanced unemployment benefits and other fiscal support. President Trump and Congress are unlikely to come to an agreement in the lame-duck session. And it won’t be until President-elect Biden takes office in January that negotiations can begin anew.

Some elements of enhanced federal benefits, such as the $600 per week Pandemic Unemployment Assistance, have already expired. Without some legislative compromise, the economy risks more permanent scarring. According to the Department of Labor, nearly one million people lost benefits in July and August, and three million people received their final check in September. That number will keep rising; up to 12 million Americans face a benefit cliff at year-end.2

Split government complicates matters The widely anticipated “Blue Wave” failed to materialize. The 2020 election is on track to have the fewest party control changes at the state level since 1944.3 At current count, Republicans maintained control of 30 state legislatures and 26 governor mansions, with total control in 22 states (compared to 15 for Democrats).3 We believe the GOP is favored to retain control of the US Senate, thus resulting in a split government. Even if Democrats manage to win both runoff races in Georgia, the Senate’s composition will be 50-50, with Vice President-elect Kamala Harris as the tiebreaking vote. But moderate Democrats, such as Senator Joe Manchin, are unlikely to support the more controversial policies of the progressive wing.

Executive Authority: The Achievable

The President as CEO The election outcome certainly hinders President-elect Biden’s legislative agenda, but don’t expect this administration to sit on its hands. The President has many levers to pull to achieve policy priorities. The President is the CEO of the federal bureaucracy, which is the largest purchaser of goods and services in the US, with the power to control procurement rules for contracts.4

That’s no small matter: In FY2019, federal contracts for goods and services totaled more than $586 billion, or about 40% of all government discretionary spending.5 As CEO, the President can also exert control over federal personnel through the civil service, which employs an estimated 2.1 million people.6 Compare that to Walmart, the country’s largest private employer with around 1.5 million employees.7 In short, Biden can’t pick what the government spends money on, but to some extent, he can decide how and where to direct it.

Vigorous and early executive action The Biden Administration is expected to use executive actions early and extensively in areas such as climate, education, financial services, foreign policy, national security, healthcare, and immigration. Biden has promised to rejoin the Paris climate agreement and to issue executive orders that achieve elements of his climate plan. He could eliminate limits on international student visas and reverse the Trump Administration’s efforts to end DACA, the program that allows certain immigrants brought to the US as children to remain in the country. He’s also likely to shore up the Affordable Care Act by rolling back many of President Trump’s actions, such as Medicaid work requirements and work grants.

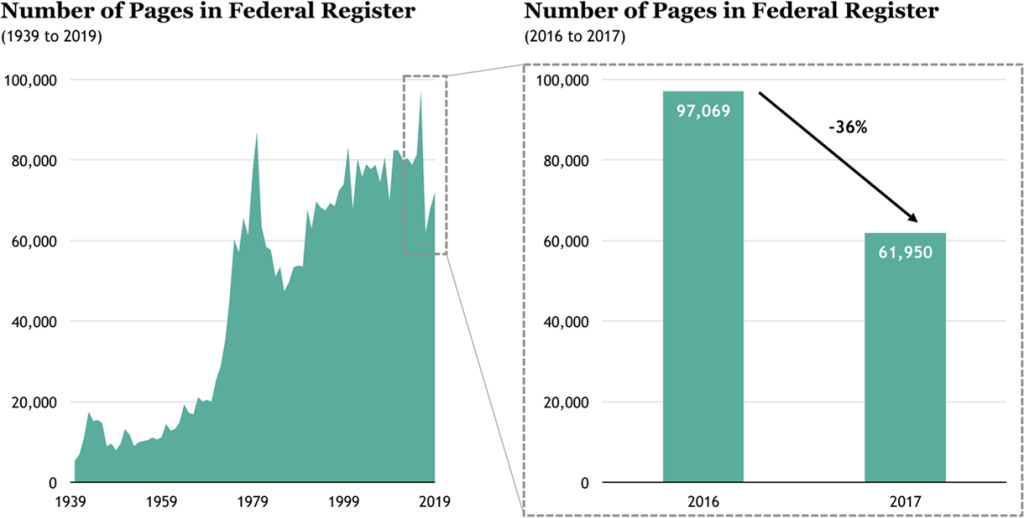

Policy shaped through regulation Federal regulation steadily increased over the past four decades, reaching an all-time peak by President Obama’s final year in office in 2016. Within weeks of President Trump’s inauguration, he signed Executive Order (EO) 13771, which introduced the “2-for-1” rule (also known as “One in, Two Out”). The rule mandated that for each new regulation, federal agencies must identify two regulations for elimination.

As Figure 2 shows, within a year, the number of pages in the Federal Register, a proxy for the federal regulatory burden, shrank by 36%, the largest one-year decrease since 1947.8 In the first year of Biden’s presidency, we might expect the same thing in reverse: a slew of executive orders and regulations that aim to achieve his policy priorities in energy, climate, financial services, education, and labor.

Figure 2: Historical Analysis of Federal Regulations

Source: Office of the Federal Register and Haver Analytics, as of 12/31/19. This series is used to track the flow of new government regulations each year and as a proxy for the federal regulatory burden.

Fiscal Policy: In Need of Common Ground

Legislation won’t be easy Wide partisan divides are likely to remain after President Trump’s departure from the Beltway. Consider, for example, the $2.1 trillion pandemic-aid package that House Democrats passed and the $1.8 trillion that the Trump Administration counter-offered, relative to the smaller, targeted $500 billion bill that Senate Majority Leader Mitch McConnell proposed. That’s a significant difference, and Trump, for his part, was much closer to the Democratic side of the issue.

Some compromise possible So what of President-elect Biden’s ability to achieve some of his legislative agenda? It’s a daunting task, but even with a GOP Senate, we see potential for compromise, given Biden’s longstanding relationship with his old Senate colleague McConnell. The hope is that political brinkmanship can be reduced somewhat, allowing for smoother negotiations on basic governance issues, like keeping the government funded. Areas of compromise could include a COVID relief package, elements of Biden’s “Made in America” platform that emphasize domestic job creation and investment, and certain national security policies, on which some Republican lawmakers had differences of opinion from the current administration.

High stakes for fiscal support Another round of fiscal support is needed to ease the economic fallout from renewed local shutdowns and restrictions amid COVID’s resurgence. As we wrote in Unintended Consequences of a Dovish Shift, we expect that a lack of further large-scale fiscal stimulus would force the Federal Reserve to step up its efforts to support the recovery. The Fed is expected to use progress on fiscal talks (or lack thereof) as a factor in its December meeting. If the Fed feels that the recovery were at risk and that fiscal support were not forthcoming, it could announce stronger economic outcome-based forward guidance on zero rates and new asset purchases.

Policy to Create Pockets of Opportunity

Policy shifts, investment opportunities follow As new policies are implemented, we expect investment opportunities to arise across multiple sectors in the economy. One particularly urgent need for domestic investment is the medical supply chain. The US relies heavily on imported drugs, medical equipment and personal protective equipment (PPE); it imports over $132 billion per year in just the pharmaceutical products category.9 Recent trade disputes brought attention to the trend, but the pandemic increased its significance. For example, it’s estimated that at the height of the COVID crisis last spring, US companies were manufacturing approximately 50 million N95 masks per month, but demand was for around 300 million masks per month.10 Another area of interest is the supply chain for certain critical drugs like antibiotics and painkillers, for which the US is almost entirely dependent on imports.

Demand for medical supplies will only increase as countries replenish stockpiles and bolster resiliency for future health emergencies. As we wrote in the June essay, even before the COVID onslaught, US demand for medical devices alone was estimated to exceed $106 billion by 2023. The Federal Reserve recently estimated that the US trade deficit in critical medical supplies doubled over the past decade. The deficit for products ranging from simple goods like hand sanitizer, masks, and gloves to complex equipment like ventilators and oxygen masks increased from 7% in 2012 to 14% in 2018.11

We expect that future government policy will aim to encourage more domestic manufacturing of these products. At the same time, investment in air quality could become a significant theme in healthcare, as COVID-19 is the fourth respiratory epidemic in the last 20 years. Aerosol transmission is becoming better understood, and that will lead to a rethinking of interior spaces. Buildings are airtight today following decades of improved energy conservation. Life Science office parks offer some clues. Technologies from “light” life sciences (think computational and research vs. labs) could influence office buildings, airplanes, homes, and even cars.

We will expound on these subjects and more in our Ten Surprises of 2021, which will be released on January 4th, and in our quarterly webinar, which will be available on January 7th. On behalf of Byron and the team, we wish you all the best for a happy and healthy holiday season.

With data and analysis by Taylor Becker.

- Centers for Disease Control and Prevention, as of 9/10/20.

- US Department of Labor and the Century Foundation, as of 11/18/20.

- National Conference of State Legislatures, as of 11/11/20.

- Gitterman, Daniel Paul. Calling the Shots: The President, Executive Orders, and Public Policy. Washington, D.C.: Brookings Institution Press, 2017.

- US Government Accountability Office, as of 5/28/20.

- Congressional Research Service and Office of Personnel Management, as of 10/23/20.

- Fox Business, as of 6/19/20

- Office of the Federal Register and Haver Analytics, as of 12/31/19. This series is used to track the flow of new government regulations each year and as a proxy for the federal regulatory burden.

- US International Trade Commission, as of 12/31/19

- Holland & Knight, as of 4/13/20.

- Federal Reserve Bank of St. Louis, as of 4/8/20

The views expressed in this commentary are the personal views of Joe Zidle and Byron Wien and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle and Byron Wien as of the date hereof, and none of Joe Zidle or Byron Wien nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.