Several themes emerged from the discussions. First, the workweek has changed with more people working at least part of the time at home. Second, climate change is real and will have an indefinite impact on weather patterns and profitability. Third, the conflict between democracies and autocracies is likely to persist, increasing the cost of defense. Fourth, budget deficits at the Federal, State, and local levels and abroad are likely to keep interest rates high and put pressure on equity price-earnings ratios. Fifth, artificial intelligence is a game changer, much like the internet was, and is likely to improve productivity, but its impact on employment is hard to determine.

Lifestyles are clearly changing with more people putting working at home or free time on an equal footing with financial success. We discussed the profound effect this is having on the office real estate market, with occupancy throughout the United States being impacted. Vacancies among office buildings in major cities are around 20%, which has an impact not only on the value of the properties but also on the real estate tax revenues of state and local governments. If rental income from a building is down sharply and the landlord has a mortgage, giving up ownership to the holder of the mortgage may be sensible. This will put pressure on banks and insurance companies who are traditional holders of mortgages. The large money center banks that loan money to major corporations will be less affected, but regional banks will suffer a greater impact.

On climate change, the world is falling behind on its goals of reducing carbon emissions. Even if the United States stops emitting carbon, we will still have a problem because China and India are generating much of the electricity in their countries with coal. Using nuclear power could be part of the solution; France generates 70% of its electricity using that resource, but today it’s a political non-starter in the United States. Despite the improvements that have been made to the safety of nuclear power plants, these sources of power are making slow progress. The oil experts attending believe we will be using fossil fuels to power transportation for at least the next twenty years.

On the economy, the strong performance of the stock market and the recent report on Gross National Product has led the consensus to believe we will have a soft landing rather than a recession. As a result, the consensus was that the Federal Reserve will pause in making further rate increases to make sure that the economy remains on a growth path. A minority of participants felt that, despite the combination of an inverted yield curve of 100 basis points and the leading indicators headed lower, the Fed will be encouraged to increase interest rates by 25 basis points one or two more times given the Federal Reserve target of 2.0% inflation and the Personal Consumption Expenditure Price Index still above 4%. Inflation is, however, clearly coming down on virtually all fronts and that is what is encouraging the optimists. Favorable news on the economy has preceded most recessions before a sudden drop in business activity occurs. Be wary of extrapolating present market performance into the future. Monetary tightening works with an eighteen-month lag, putting the start of a potential recession late this year or early 2024.

We had an extensive discussion on artificial intelligence at every session. Some attendees with deep experience in the area believed that the tool will be important, but the current excitement is overdone and it will take four or five years for AI to be effectively worked into the economic system. Many desk job tasks can be reduced, simplified or eliminated and productivity will improve, perhaps doubling in next five years. A few of the largest companies in the artificial intelligence field are spending as much as $1 billion each on large language models. There will be significant advances in manufacturing, healthcare, the legal profession and language translations. The big question is whether there will be a market for the product of these improvements. Some regulation will be necessary to control malevolent people from using the AI tools; the problem will be separating the wrongdoers from the positive initiators. Those who are optimistic about the future of technology believe that AI is the next phase of important breakthroughs. Doctors will make better decisions about treatments around the world. Tutors will help people to learn more effectively. Progress in climate change will occur because of new engineering, new materials, new math, new chemistry, and new advancements in biological research. New drugs will be introduced more quickly. Conversely, AI may play a negative role in the next election and we must safeguard against that. There will be cyberattacks against corporations, individuals and politicians. Biological weapons could be developed using AI tools. While AI will help offset declining populations in many industrial countries, the benefits will only be available to those with the necessary technical education to utilize the new tools.

We discussed the 2024 election at every session. The participants were with the consensus in hoping that someone other than the current presumed candidates would be on the ticket for both parties, but there was general agreement that the race would be between Trump and Biden, with uncertainty about the outcome. Trump would lose some voters because of his legal problems, but most of them would be unlikely to cast their vote for Biden. Biden, because of his age and familial problems, lacks enthusiastic support, but most Democrats would, of course, have trouble voting for Trump. This may result in low turnout, which could affect the Senate and House elections. One participant said that what was needed was better presidential leadership.

While the war in Ukraine seems endless, there was general agreement that within the next year there will be a ceasefire but no peace agreement. Putin is beginning to run into political resistance within Russia because of the economic cost and human casualties of the war. In Europe and the United States, most right-wing groups believe we should not be spending so much providing aid and arms to Ukraine when we have so many problems at home, including homelessness, housing, poverty, and immigration. Some felt that democracy is at stake. If Russia claims even parts of Ukraine through force, Putin may attempt to occupy areas elsewhere. Many feel he must be stopped and it is up to the West to provide the means to do that.

On China, there was general agreement that the economic slowdown was a significant development. Growth well below the 5.5% target was a big disappointment in spite of considerable monetary stimulus. Many housing developments, which are the principal means for personal savings, are in danger of bankruptcy. The country is suffering from deflation. Xi Jinping’s power is not being challenged. The problems at home are significant enough to discourage Xi from embarking on any military adventures abroad and that makes any attempt to take over Taiwan less likely, although some think he might try that as a distraction from problems at home. The United States has been vigorous in trying to improve its relationship with China. The Blinken and Yellen trips are examples. Trade with China, back and forth, is $700 billion, so we are both important to each other. That must be the basis for a more harmonious relationship. The ideological difference must become less important. In spite of the problems, there are a number of cheap stocks there, but few in the group had the appetite to invest.

Investors are worried that the escalation of government debt will become a major problem. Interest costs have risen from 2% to 3%, adding another $100 billion to the annual cost which is already 7% of Gross Domestic Product and will rise to 14% in a decade. There is a limit to what taxpayers will pay and lenders will provide, but the severity continues to be ignored. One in the group quoted Marcel Duchamp, who said, “There is no solution because there is no problem,” but that seems facile. At a minimum, a central debt burden is likely to mean that interest rates will stay higher. The hope is that AI will increase growth and this will help us out of the problem, but it is unlikely to be enough for the foreseeable future. We are likely to have fewer lawyers, accountants and consultants, but more health care and service workers in building trades and home assistance.

As much as I tried, I couldn’t get anyone to comment on our problems with education. We are still not getting more than 75% of our children to graduate from high school. What is the future of the 25% not graduating? Will we have enough technologically trained people to meet the increasingly complex needs of the economy? In the Middle East, the prospect of Iran having the capability of producing a nuclear bomb is increasing and that will create a power imbalance there. China is getting involved in the area. The economies are booming, so the countries want a place at the geopolitical table influencing policy.

In conclusion, a majority thought the US economy would have a soft landing. The S&P 500 would hit 5,000 sometime in the next few months. Inflation would move toward 2% but not get there. It was summer in the Hamptons and the sun was out most of the time. Most of the participants were very comfortable financially and living a good life. Returns may be lower in the future, but that won’t change.

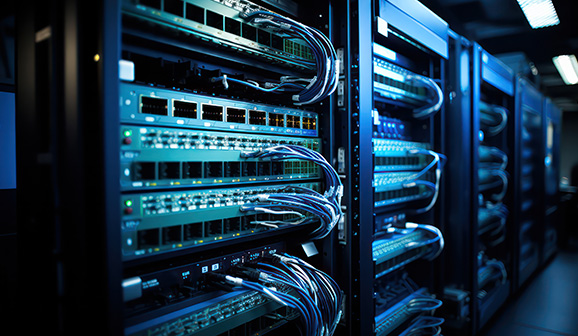

Behind the Deal: AirTrunk, Data Centers and Blackstone’s Digital Infrastructure Strategy

January 15, 2025