Market dislocation and strains on the US banking system have drawn attention to private credit—debt that is privately originated and not traded on the public markets. But in fact, private credit has been experiencing secular growth for years, expanding from 5% of the sub-investment grade market in 2005 to 24% in 2022.[ 1 ]

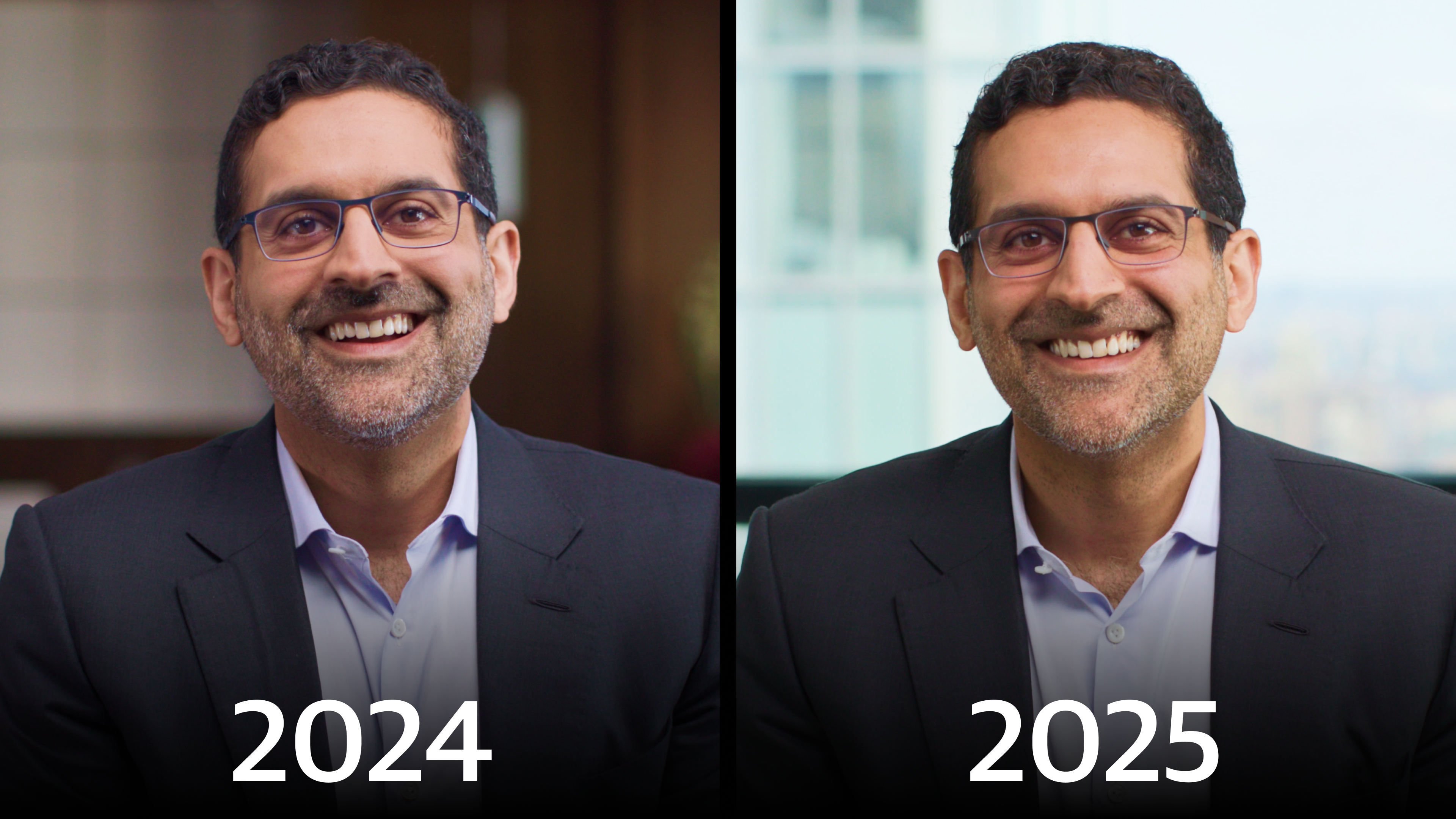

While some observers may believe that private credit is high-risk, we consider it defensive—provided that lenders back strong businesses, remain senior in the capital structure and put the right protections in place. Brad Marshall, Blackstone’s Global Head of Private Credit Strategies, discusses our approach and what makes private credit attractive to both investors and borrowers today.

A Broader Toolkit to Capitalize on the Credit Opportunity | The Connection

February 13, 2025