Moving past the “easy” inflationary stuff A certain amount of disinflation was always baked in, as the generational, pandemic-induced supply chain disruptions were bound to be resolved eventually. Those supply issues challenged everything from inventory management to port logistics. Housing prices, which have lagged market data but will start showing through in the near term, will help to alleviate headline inflation.

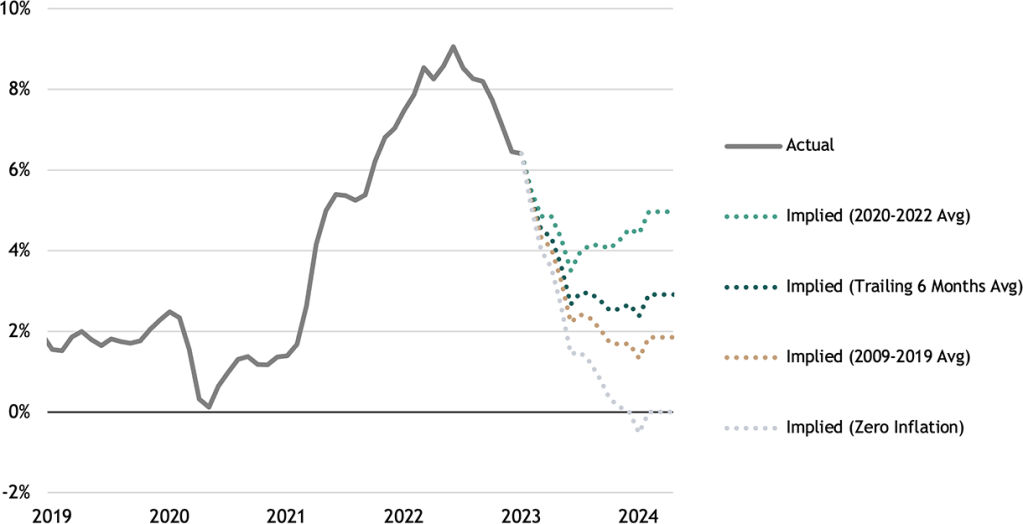

Base effects also play an important role. To maintain year-over-year inflation at its current pace would require monthly increases of 0.9%, which is six times the pre-COVID average of 0.15%. Even so, January CPI rose by 0.5% month-over-month, and it’s averaged 0.24% MoM in the trailing six months. At that rate, YoY inflation would settle out around 3%, as Figure 1 shows. That may not be what happens, but the path down is likely to be bumpier than many expect.

Figure 1: Hypothetical Paths for the YoY% Change in the US Consumer Price Index

(Implied based on various historical average MoM increases)

Source: Bureau of Labor Statistics and Blackstone Investment Strategy calculations, as of 1/31/2023.

All data beyond 1/31/2023 are hypothetical, and assume various monthly increases based on actual historical data over the time periods specified.

In my view, these forms of disinflation, once they’ve worked their way through the system, are insufficient on their own to return price growth to the Fed’s 2% target. Taming historically tight labor markets is the next—and I think the costlier—phase of the inflation fight.

Wages will be tougher to rein in The January jobs report showed that more must be done to cool red-hot labor markets and slow wage growth. The latter has declined to 5%, which is still too high for the Fed’s comfort. The Employment Cost Index, which is the “gold standard” because it controls for issues like mix-shift, continues to increase at historically high rates and has rolled over durably. Labor demand remains well above the supply, with millions more job openings and millions fewer workers relative to pre-COVID trend. Also, labor market turnover remains high. The unemployment rate reached a 50-year low at 3.4% in January, which is simply not consistent with significant moderation in wage growth.

Blackstone’s unique perspective on labor markets In aggregate, Blackstone owns around 250 portfolio companies, which collectively employ approximately 700,000 people across industries and sectors. Every quarter we survey a subset of our portfolio company CEOs, which always provides us helpful insights on the state of labor markets. We found the 4Q survey particularly insightful, as respondents anticipate increasing wages by mid-single digits in 2023. That’s down from 2022, but still contrasts sharply with the pre-COVID average, which was closer to low-single digits.

Survey respondents report early signs of cooling The number of open positions across the respondents’ portfolio companies has declined from COVID-era highs, thanks to a combination of improved hiring conditions and a simultaneous moderation in hiring needs. However, vacancies remain higher than pre-COVID levels, and CEO survey respondents indicate that they generally expect to continue to grow their workforces. Also, this subset of CEOs expects a softening in overall business conditions, which means there will be somewhat less competition in attracting labor.

I believe the current wage gains likely push the ceiling higher on rates. While talk of a 50 basis-point hike in March is creeping into the markets, my focus is on the timing of cuts. For that, I still take the “over” relative to consensus. As we wrote in our Ten Surprises in January, the Fed may put the word “pivot” on the shelf next to “transitory.” In my view, investors should remain vigilant and pay close attention to the management of duration in portfolios. With a bumpy path down for inflation, and with rates higher for longer, this means that rushing to add duration may not be the wisest course.

With data and analysis by Taylor Becker.

One-on-One with Amit Dixit: All Eyes on India

February 25, 2025