Insights

Portfolio Insights

Propelling the Growth of Leading Franchisors

Market Views

Market Views: Dealmaking, Disruption, and Real Estate’s Recovery

Market Views

Why Should You Care About Data Centers?

Investment Strategy

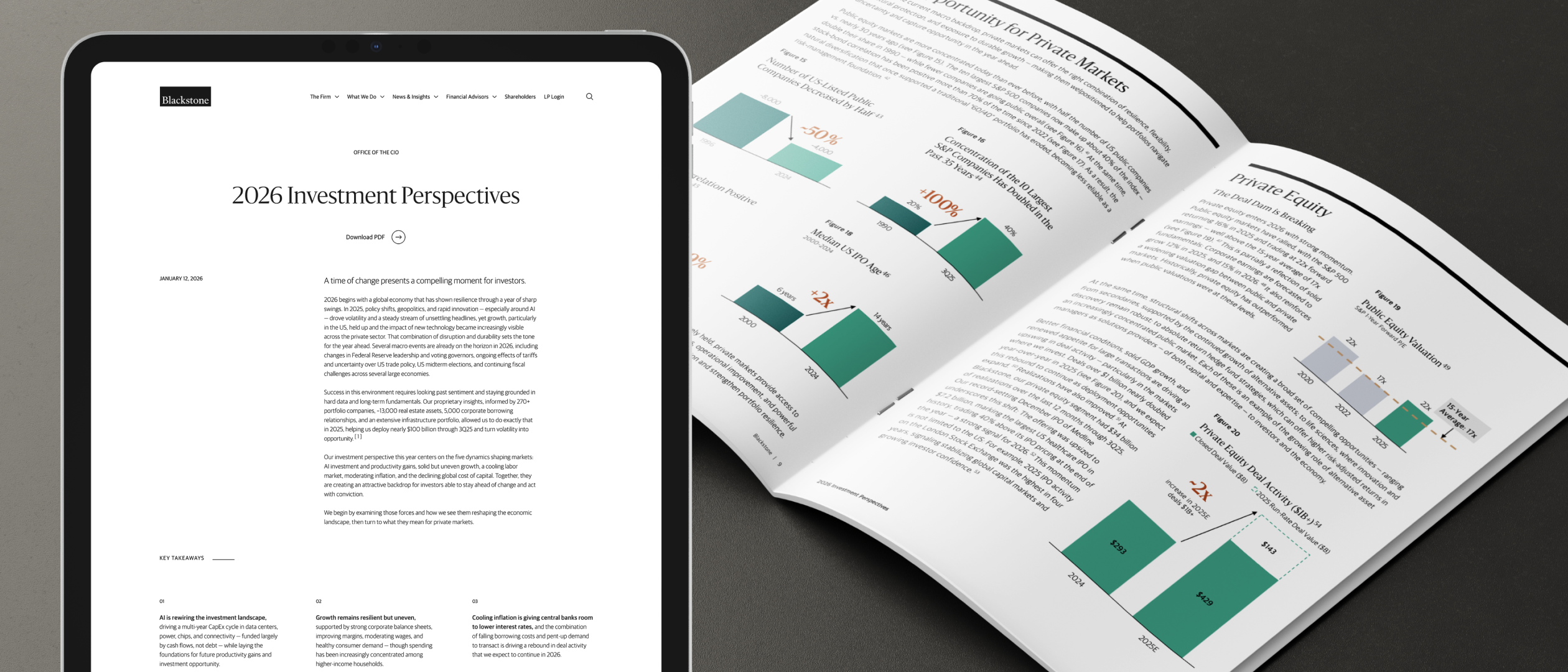

2026 Investment Perspectives

Market Views

Real Estate Enters the Next Phase of the Cycle

Portfolio Insights

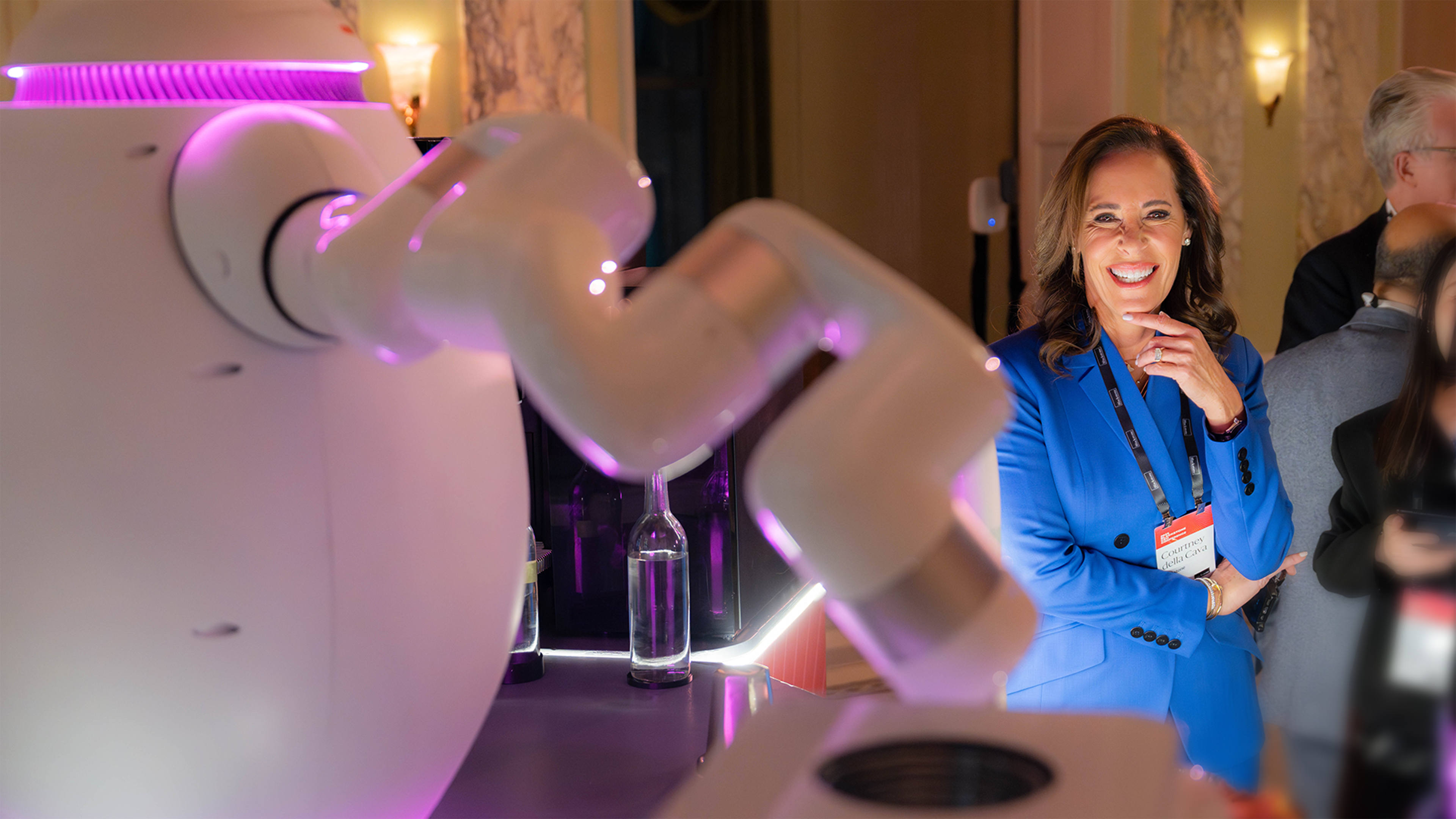

Vision, Ambition, and Humanity in the Age of AI: Insights from Blackstone’s CEO Conference

Investment Strategy

Private Credit Beyond the Noise

Portfolio Insights

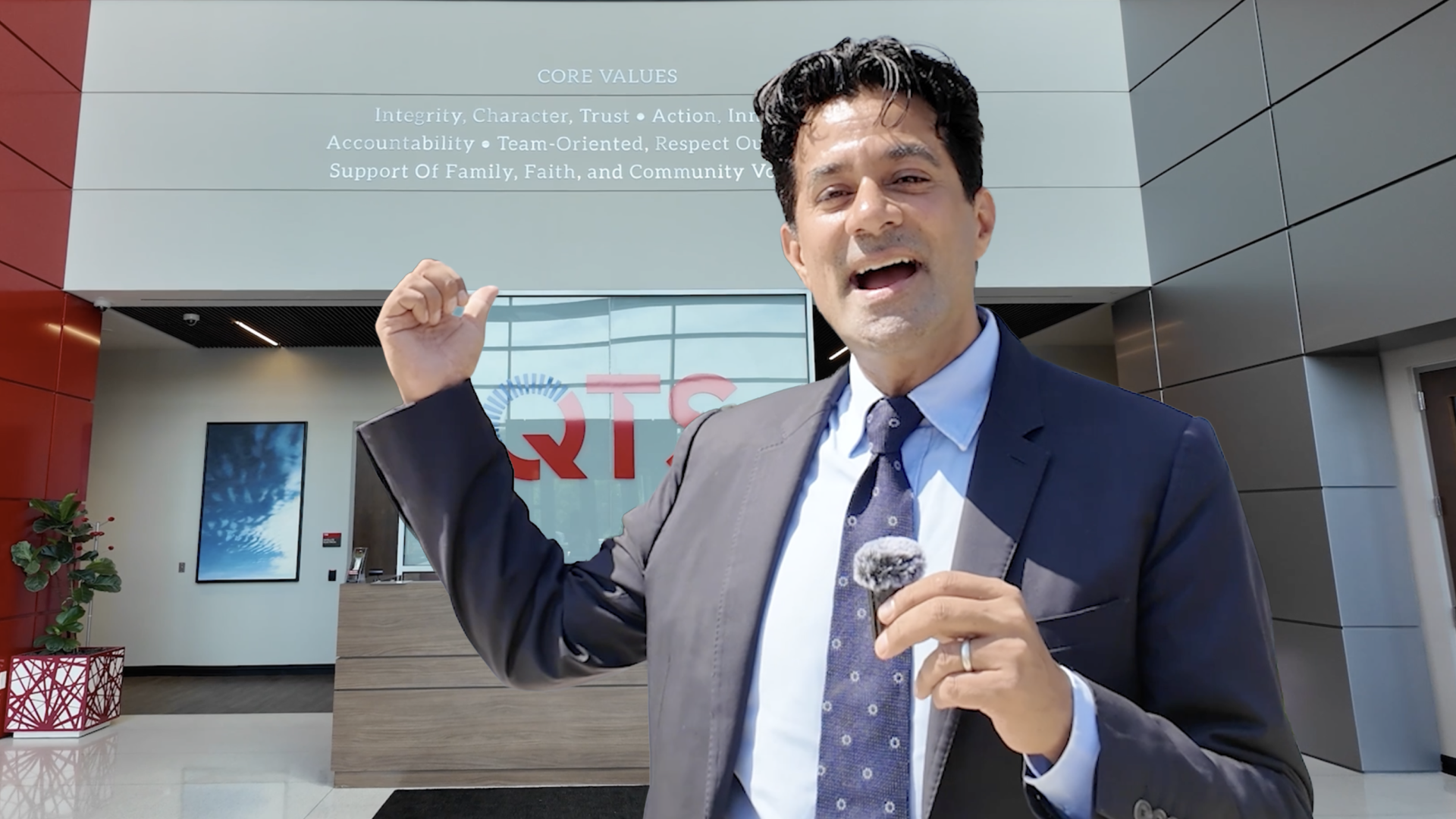

Behind the Scenes: Inside QTS with Farhad Karim

Market Views

The Deal Dam is Breaking

Investment Strategy

Rethinking the 60%

Market Views

Market Views: Is Everything a Bubble?

Firm News